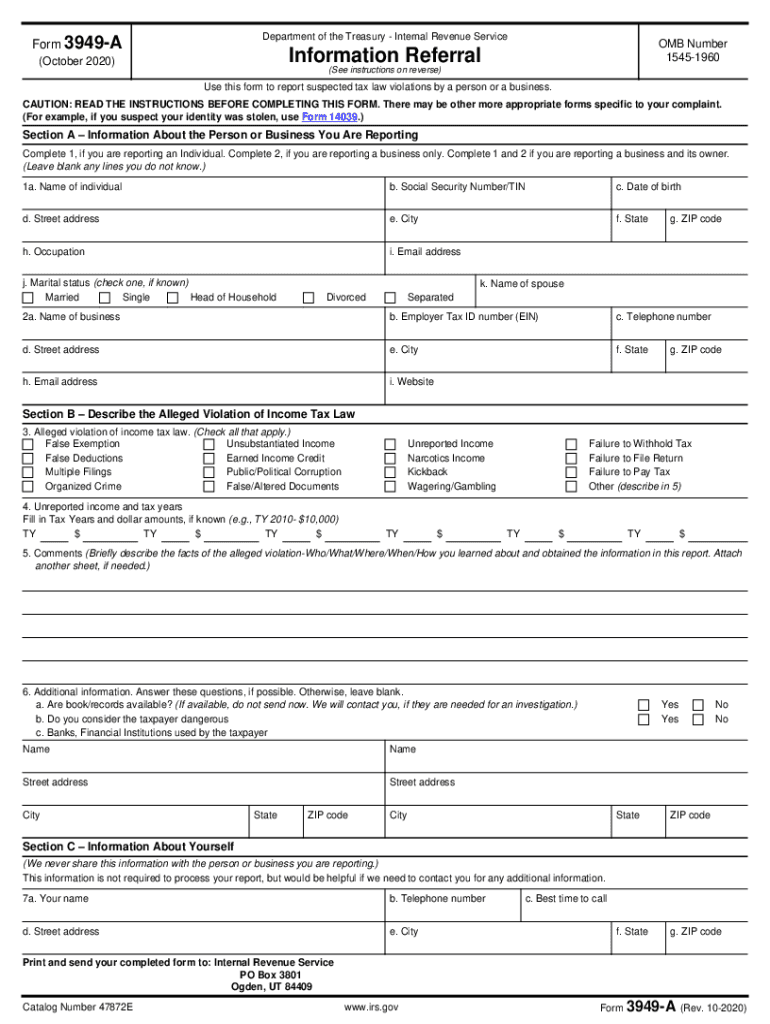

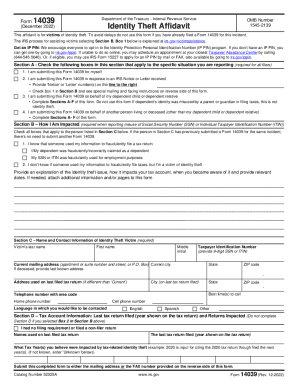

What is form 3949-a?

This form is an Information Referral that individuals can use to report any income tax violations committed by other individuals or businesses. The whistleblowers willingly complete the 3949 a form and report it to the Internal Revenue Service with any information and evidence of the suspected tax fraud.

Who needs to file IRS form 3949-A?

Customers and other individuals can complete IRS form 3949-a if they suspect any individuals or businesses in tax law violations and fraud. These may involve false deductions and exemptions, unreported income, false documents, failure to pay tax, narcotic revenue, unsubstantiated income, organized crimes, and so forth. Filing an Information Referral is voluntary, not an obligatory action. Therefore, the whistleblowers may choose to stay anonymous, confidentially reporting the tax law breach or fiscal evasion.

What information do you need when you file form 3949-a?

Before preparing your 3949 a form, please check the instructions provided on pages 2 and 3 of the document. You will also find examples of cases where you don't need to fill out this report.

Generally, you need to provide the following data:

- Give the details about who committed the violation. Please provide their full name, date of birth, SSN / TIN, contact details, occupation, and marital status for individual violators. For companies, give the name of the business, its contact information, and EIN.

- Describe the type of the alleged violation. Select an option from the list with a checkmark. Also, state the unreported income for specific tax years and comment on what you know about the alleged violation (who, what, where, and how you knew about it).

- Provide information about yourself. (This is optional.) You can leave these fields blank if you want to remain incognito. However, the IRS recommends you provide details if they need to contact you for further information or evidence.

How do you fill out the 3949-a form?

You can complete form 3949-a electronically, but it's required to file it on paper by mail. It’s possible to do both with pdfFiller, an advanced and user-friendly document editor. Here’s how:

- Click Get Form to open the form for online editing.

- Click on the first highlighted field and type in the name of the alleged violator.

- Provide details on reported violations by checking the appropriate boxes.

- Choose the state from the dropdown and use the calendar in the Date area to set when the reported case happened.

- Click Done and choose whether to print your form 3949 a or use the Send via USPS option to quickly order mail delivery right from the editor.

Is the IRS form 3949-a accompanied by other forms?

Send the printed and completed IRS form 3949 a to the IRS accompanied by any documents that prove the reported tax violation. If any books or records substantiate your report, they must be indicated. The IRS will contact you once they require these documents for their investigation.

When is form 3949-A due?

There is no due date for filing the 3949 a form. It's a voluntary document that whistleblowers may send to the IRS to report supposed tax violations as soon as they hold such information.

Where do I send form 3949 a?

A whistleblower should complete and send the printed copy of the IRS form 3949-a to the address below:

Internal Revenue Service,

PO Box 3801

Ogden

UT 84409